Internationalisation

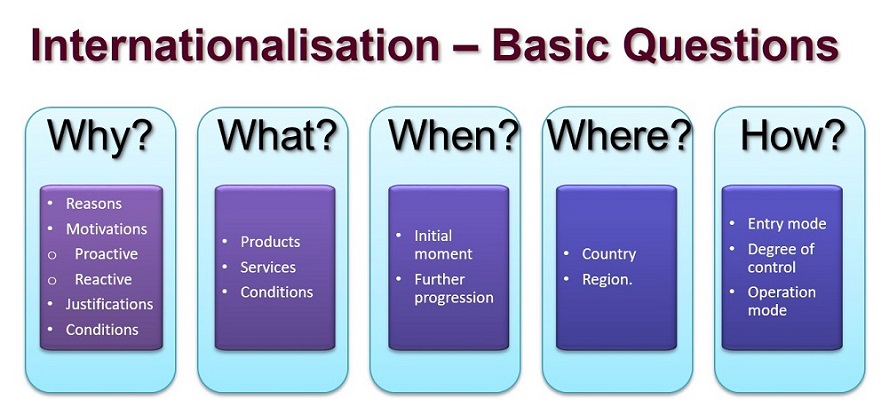

Most international businesses have the fundamental goals of expanding market share, revenues, and profits. They often achieve these goals by entering new markets or by introducing new products into markets where they already have a presence. In order to increase market share, revenue, and profits, firms must follow three steps:

- assess alternative markets,

- evaluate the respective costs, benefits, and risks of entering each one, and

- select those with the most potential for entry or expansion.

Some Definitions:

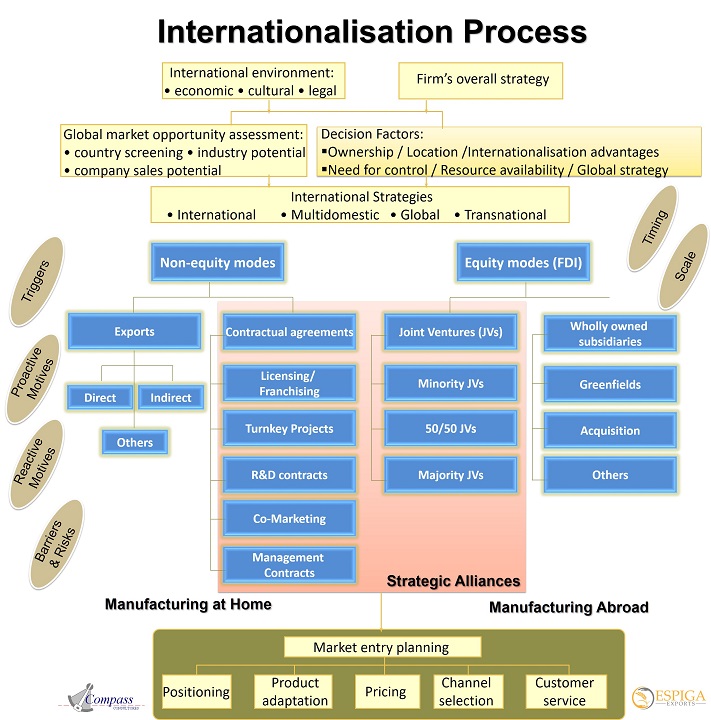

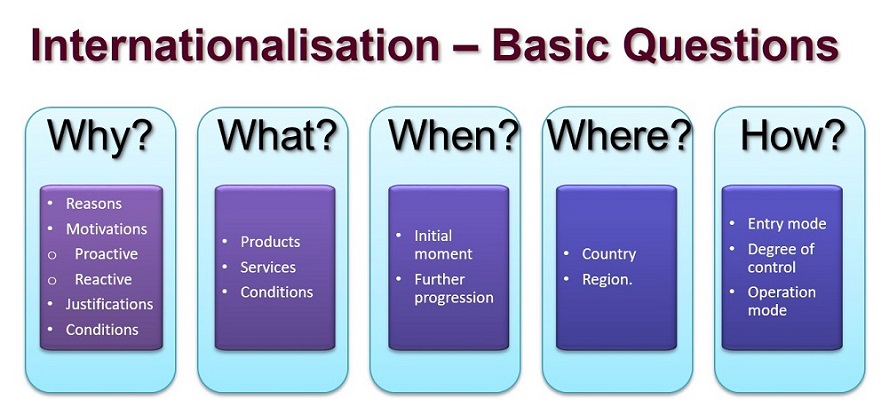

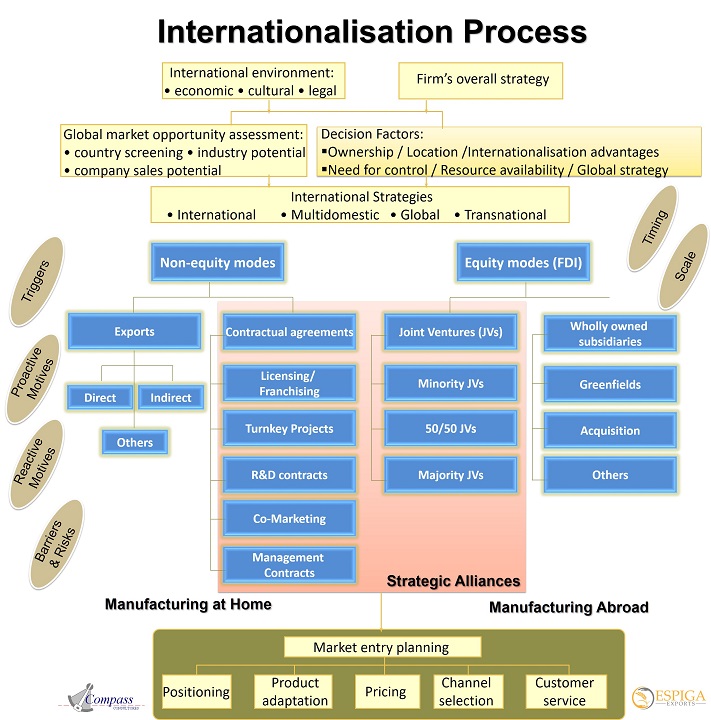

"Internationalization is the process of "increasing involvement in international operations" (Welch and Luostarinen 1988), where the firm transfers products, services and resources across countries, and is thus required to select which countries to operate in and the mode of operation.'

"Market Entry: Arguably "the most significant international marketing decision [most companies] are likely to take is how they should enter new markets, as the commitments that they make will affect every aspect of their business for many years ahead" - (Doole & Lowe, 1999)

International Strategy: A strategy through which the firm sells its goods or services outside its domestic market

- Also referred to as geographic diversification

- Implications at both corporate and business level

- Used as a growth strategy

- Level and type of geographic diversification

- Level - # of countries, markets, or regions

- Type - Multidomestic, Global, Transnational

- Mode or means of entry

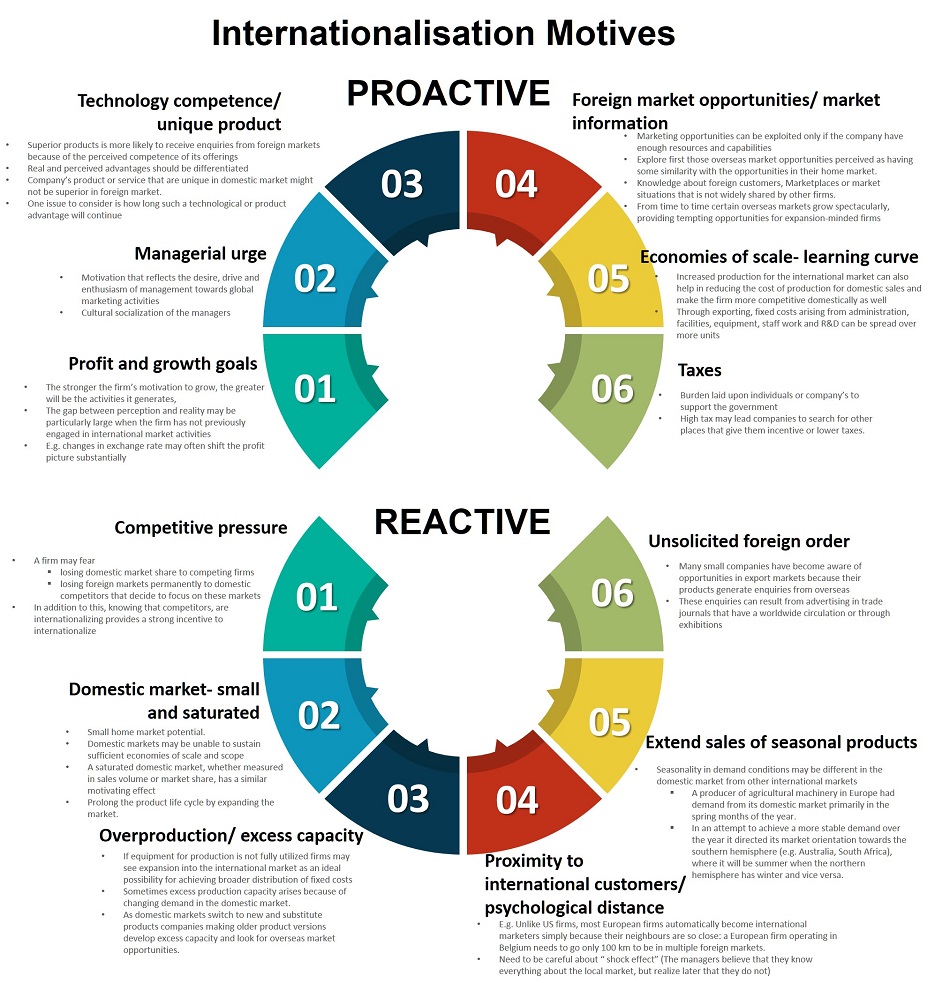

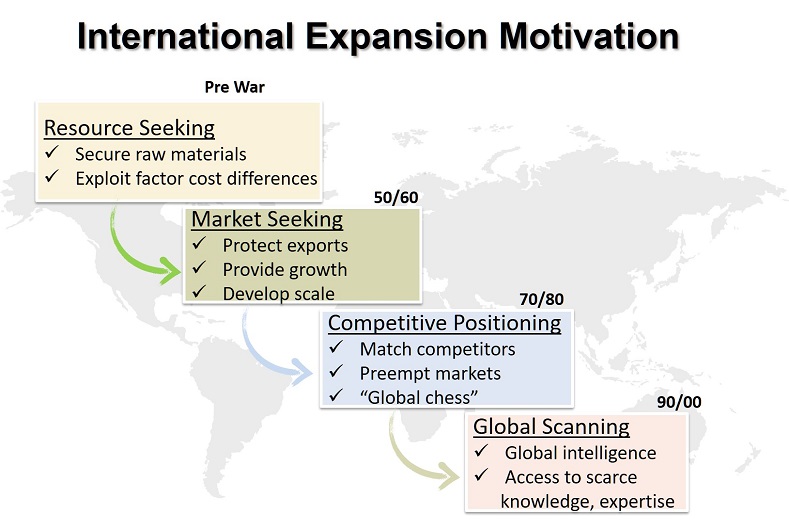

Internationalisation Motives

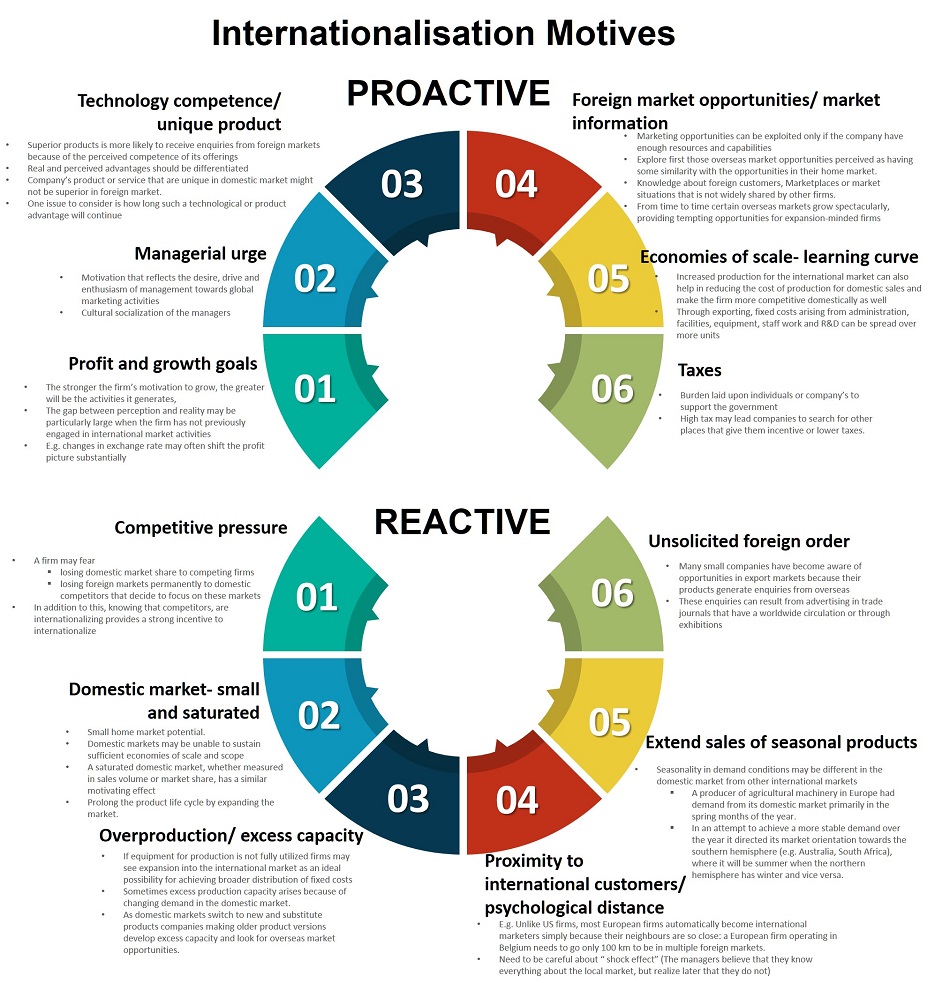

Proactive motives

- Profit and growth goals

- Managerial urge

- Technology competence/unique product

- Foreign market opportunities/market information

- Economics of scale

- Tax benefits

Reactive motives

- Competitive pressures

- Domestic market: small and saturated

- Overproduction/excess capacity

- Unsolicited foreign orders

- Extend sale of seasonal products

- Proximity to international customers/psychological distance

We could see the internationalisation process in the Market Development and Diversification grids of the Ansoff's Matrix

Six guidelines for when market development may be an effective strategy

- When new channels of distribution are available that are reliable, inexpensive, and of good quality.

- When an organization is very successful at what it does.

- When new untapped or unsaturated markets exist.

- When an organization has the needed capital and human resources to manage expanded operations.

- When an organization has excess production capacity.

- When an organization's basic industry rapidly is becoming global in scope.

Six guidelines for when related diversification may be effective

- When an organization competes in a no-growth or slow growth industry.

- When adding new, but related products would enhance sales of current products.

- When new, but related products could be offered at competitive prices.

- When new, but related products have seasonal sales levels that counterbalance existing peaks and valleys.

- When an organization's products are in the decline stage of the life cycle.

- When an organization has a strong management team.

Unrelated Diversification is a form of diversification when the business adds new or unrelated product lines and penetrates new markets

An unrelated diversification strategy favors capitalizing upon a portfolio of businesses that are capable of delivering excellent financial performance in their respective industries.

Ten guidelines for when unrelated diversification may be effective

- When revenues derived from an organization's current products or services would increase significantly by adding the new, unrelated products.

- When an organization competes in a highly competitive and/or no-growth industry.

- When an organization's present channels of distribution can be used to market the new products to current customers.

- When the new products have countercyclical sales patterns compared to an organization's present products.

- When an organization's basic industry is experiencing declining annual sales and profits.

- When an organization has the capital and managerial talent needed to compete.

- When an organization has the opportunity to purchase an unrelated business that is an attractive investment.

- When financial synergy exists between the acquired and acquiring firms.

- When existing markets for an organization's present products are saturated.

- When antitrust action could be charged against an organization that historically has concentrated on a single industry.

The Risk of Diversification

Diversification is the riskiest of the four strategies. Because enter in the unknown market with unfamiliar product, and lack of experience in the new skills and techniques required

The greatest risk of being in a single industry is having all of the firm's eggs in one basket. However, diversification must do more than simply spread business risk across different industries. It makes sense only when it adds to shareholder value.

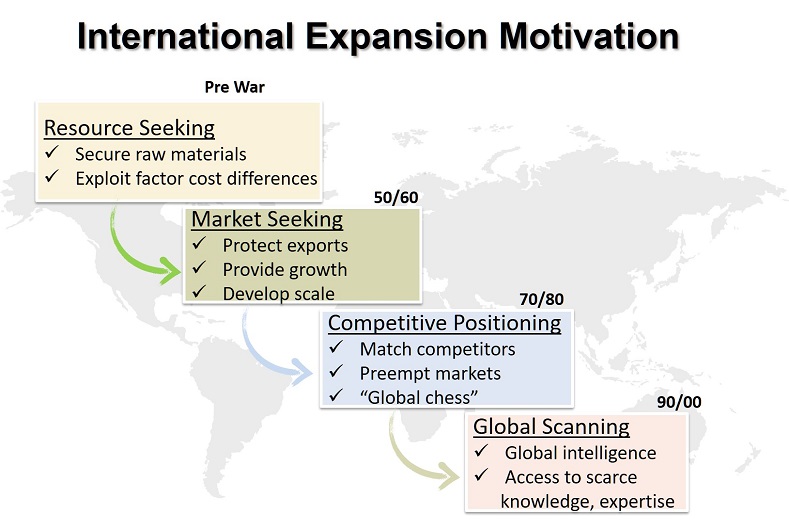

Reasons for an International Strategy

- Potential new opportunities

- Apply innovations in domestic market to foreign markets

- Extend product life cycle

- Secure needed resources

- Pressure for global integration and globally branded products

- Global economies of scale

- High potential demand for products and services

- Currency fluctuations and tariffs

- Capitalize on core competencies

- Growth

Four primary benefits

- Increased market size

- Can expand size of potential market

- Domestic market may have limited growth opportunities

- Larger markets offer higher potential returns and pose less risk for a firm's investments

- Greater return on investment (ROI)

- Large investment projects may require global markets to justify the capital outlays

- Larger markets are more attractive

- To generate above average returns on investments

- Greater economies of Scale, Scope, or Learning

- Expanding size or scope of markets can help firms achieve economies of scale in manufacturing, marketing, R&D, distribution, and service activities

- Can exploit core competencies in international markets through resource and knowledge sharing across borders

- Competitive advantages through location

- Can help the firm reduce costs

- Access to lower-cost labor, energy, and other natural resources

- Access to critical supplies and to customers

Triggers of export initiation

- Internal Triggers

- Perceptive Management: Senior managers become aware of the opportunities on foreign markets for example after they travel there. This is particular to managers that speak foreign languages and have lived abroad

- Specific Internal Event: new employee with new ideas or visions, overproduction or a reduction in domestic market size, new information

- Inward internationalization (importing): importing may precede international market entry and marketing activities. This may be initiated either by the buyer or by the seller (see next graph)

- External Triggers

- Market demand: grow in demand for some products of some companies pushes these companies to internationalize (often seen in pharmaceutics: see Squibb''s example in the book)

- Competing firms: when a competitor regards a foreign market as a potential "next entry", the other company(ies) might do the same

- Trade associations: round tables, meetings, conventions serve as an incentive to go abroad

- Outside experts:

- Export agents: have experience and could approach a company if they believe it can succeed

- Governments: Govts try to stimulate international business (ex. Export assistance)

- Chambers of commerce

- Banks

Export barriers/risks

Barriers hindering export initiation:

- Insufficient finances

- Insufficient knowledge

- Lack of foreign market connections

- Lack of export commitment

- Lack of capital to finance expansion into foreign markets

- Lack of productive capacity to dedicate to foreign markets

- Lack of foreign channels of distribution

- Management emphasis on developing domestic markets

- Cost escalation due to high export manufacturing, distribution and financing expenditures

Barriers hindering the process of exporting

General Market risks:

- Comparative market distance

- Competition from other firms in foreign markets

- Differences in product usage in foreign markets

- Language and cultural differences

- Differences in product specifications in foreign markets

- Complexity of shipping services to overseas buyers

Commercial risks:

- Exchange rate fluctuations when contracts are made in foreign currency

- Failure of export customers to pay due to contract dispute, bankruptcy, refusal to accept the product and fraud

- Delays and damage in the export shipment and distribution process

- Difficulties in obtaining export financing

Political risks:

- Foreign Govt restrictions

- National export policy

- Foreign exchange controls imposed by host Govts that limit the opportunities for foreign customers to make payments

- Lack of Govt assistance in overcoming export barriers

- Lack of tax incentives for companies that export

- High value for domestic currency relative to those in the export markets

- High foreign tariffs on imported products

- Confusing foreign import regulations and procedures

- Complexity of trade documentation

- Enforcement of national legal codes regulating exports

- Civil strife, revolution and wars disrupting foreign markets

Risk management strategies

- Avoid exporting to high-risk markets

- Diversify overseas markets and ensure that the firm is not overdependent on any single country

- Insure risks when possible. Govt schemes are particularly attractive

- Structure export business so that the buyer bears most of the risk (price in hard currency and demand cash in advance)

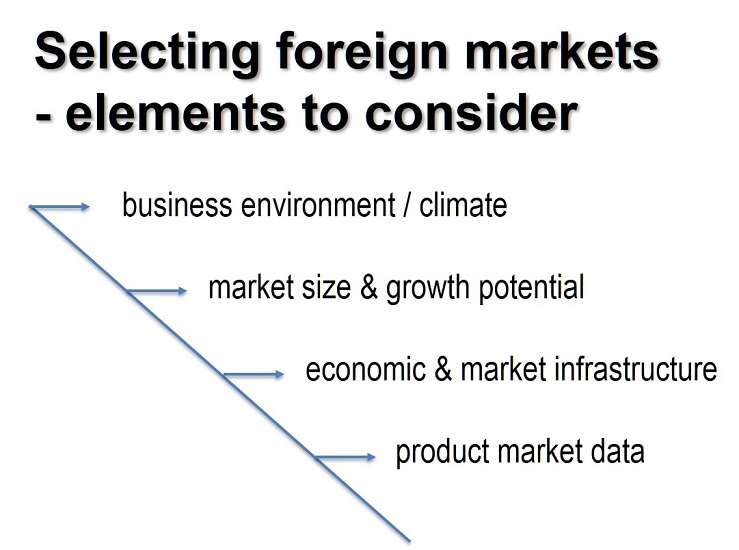

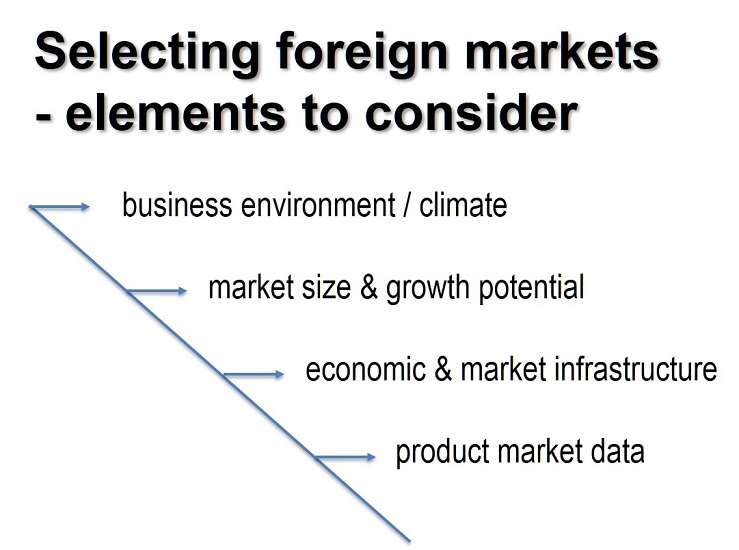

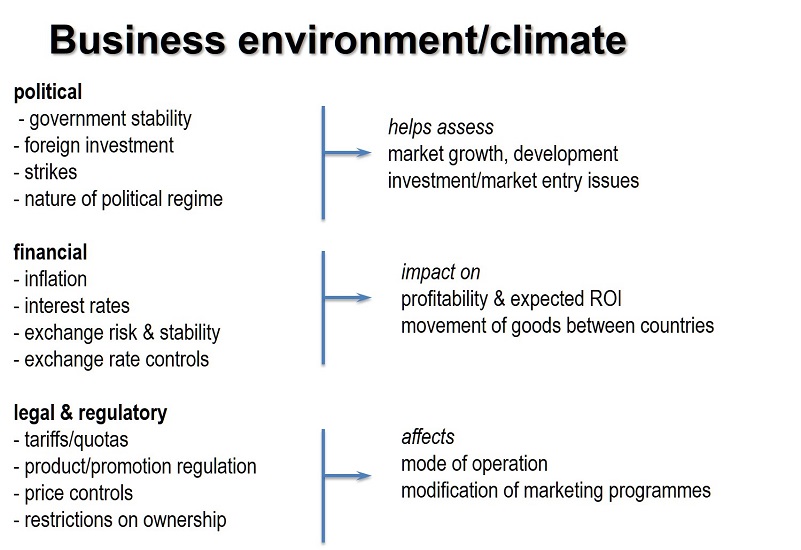

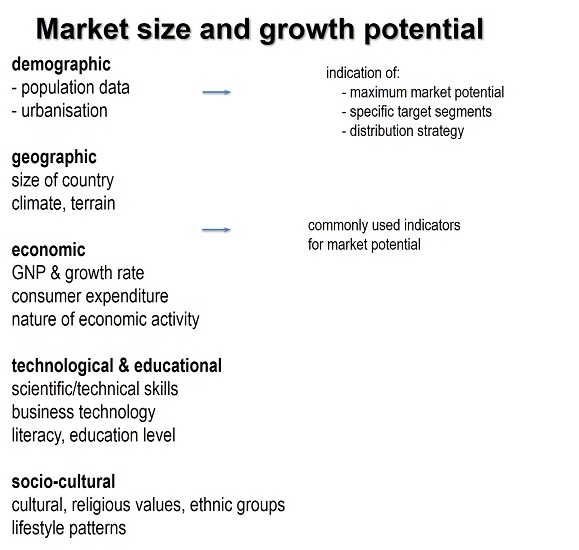

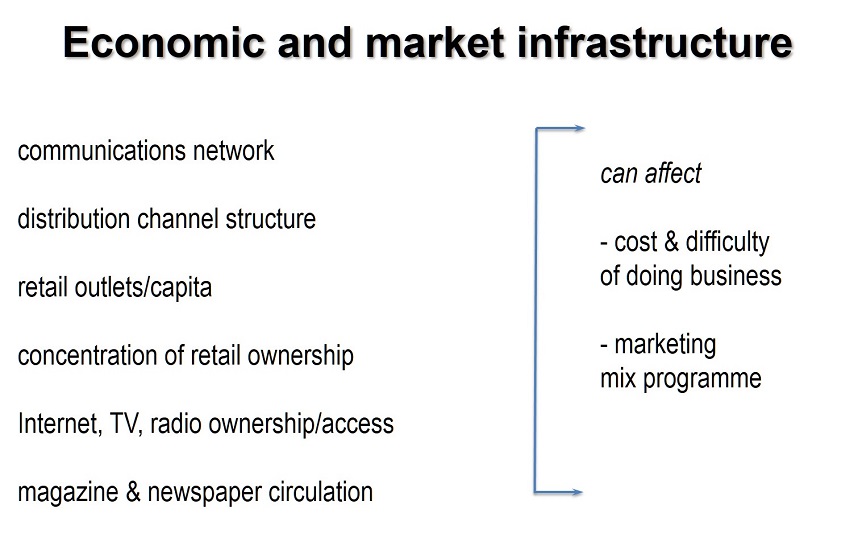

Determining Market Entry Strategy - Major Decisions:

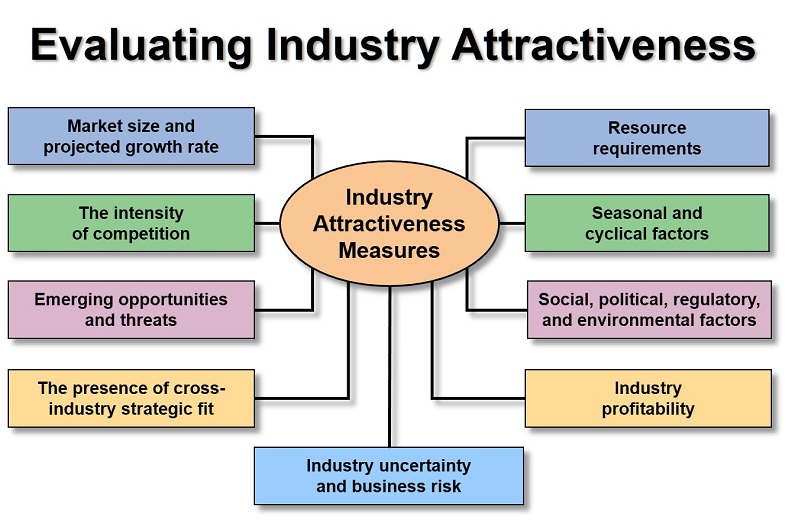

Which Foreign Markets

- Favorable benefit-cost-risk-trade-off:

- Politically stable developed and developing nations.

- Free market systems

- No dramatic upsurge in inflation or private-sector debt.

- Unfavorable

- Politically unstable developing nations with a mixed or command economy or where speculative financial bubbles have led to excess borrowing..

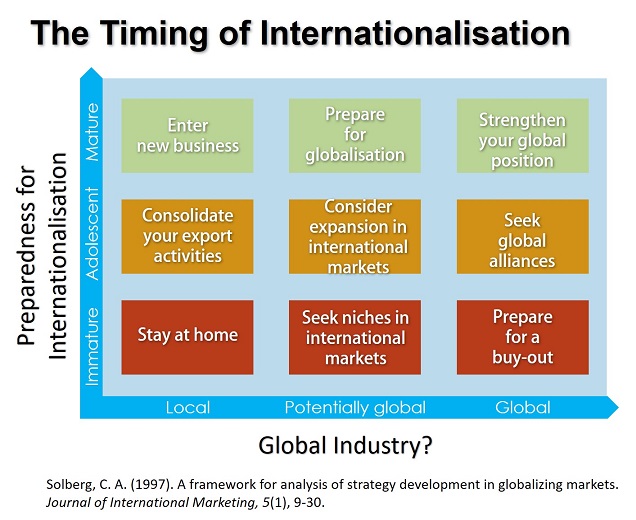

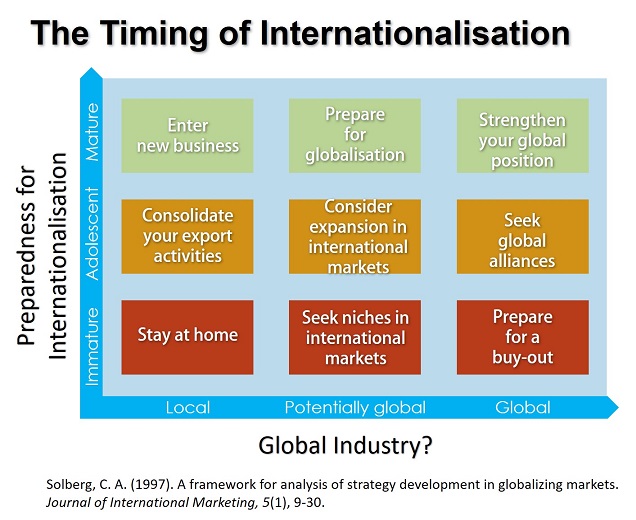

Timing of Entry

- Advantages in early market entry:

- First-mover advantage.

- Build sales volume.

- Move down experience curve and achieve cost advantage.

- Create switching costs.

- Disadvantages:

- First mover disadvantage - pioneering costs.

- Changes in government policy.

Scale of Entry

- Large scale entry

- Strategic Commitments - a decision that has a long-term impact and is difficult to reverse.

- May cause rivals to rethink market entry.

- May lead to indigenous competitive response.

- Small scale entry:

- Time to learn about market.

- Reduces exposure risk.

Some aspects:

- The most significant international marketing decision

- Commitment of resources in every aspects over a long period of time

- It signifies the company's attitude and ambition in international markets

- It determines the competitive position of the company

- Degree of control over the entire product/service offer, distribution, and profitability (repatriation)

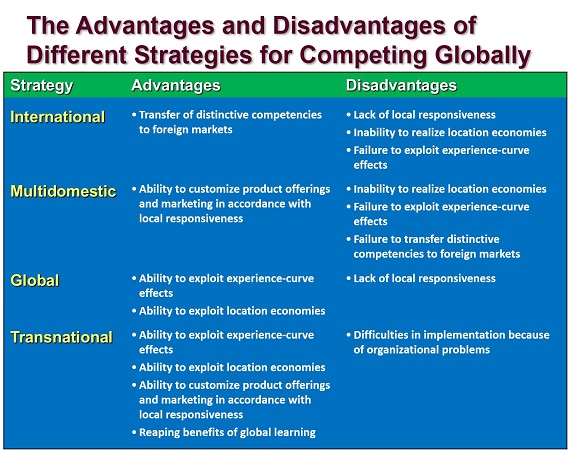

International Strategies

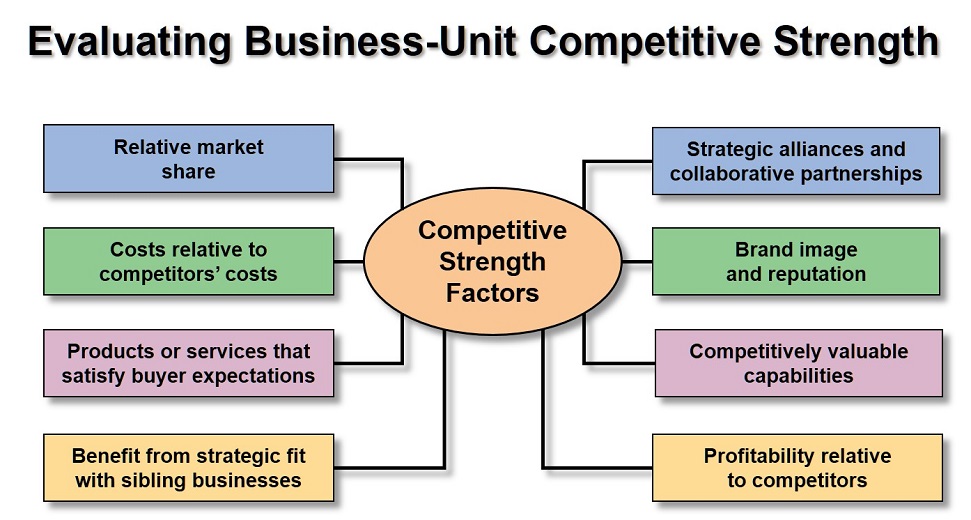

Firms can choose to use one or both of two basic types of International Strategy:

- International Business-level Strategy

- Firms select from among the generic strategies of low cost, differentiation, focused low cost, focused differentiation, or integrated low cost and differentiation

- International Corporate-level strategy

- Focuses on the scope of a firm's operations through geographic (and product) diversification, there are 3 Types:

- Multidomestic

- Global

- Transnational

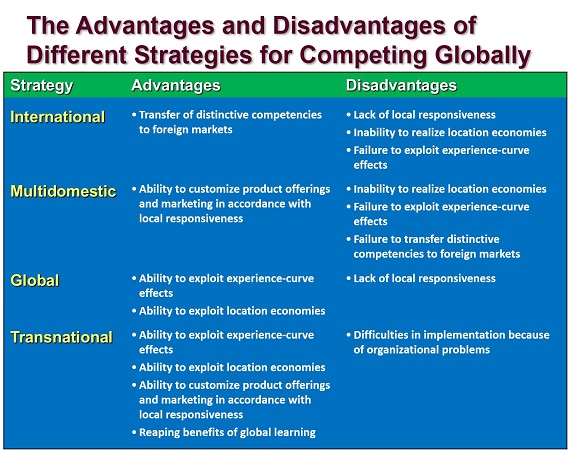

Multidomestic

- Strategic & operating decisions are decentralized to the strategic business-unit (SBU) in each country

- Focuses on competition within each country

- Assumes that markets differ and are segmented by country boundaries

- Customized products to meet local customers' specific needs and preferences

- Deals with uncertainty due to differences across markets

- Different competitive/business strategy in each market

- Think local and act local

- Addresses need for local responsiveness

Global

- Competitive strategy dictated by the home office

- Emphasizes economies of scale

- Strategic & operating decisions centralized at home office

- Involves interdependent SBUs operating in each country

- Home office attempts to achieve integration across SBUs, adding management complexity

- Produces lower risk

- Is less responsive to local market opportunities

- Same competitive/business strategy in all markets

- Think global and act global

- Addresses need for global integration

Transnational

- Requires both global coordination and local responsiveness

- Flexible Coordination

- Challenging, but becoming increasingly necessary to compete in international markets

- Growing number of global competitors increases need to lower costs while greater information flow and desire for specialized products pressures firms to differentiate and even customize products

- Tailor strategy where needed

- Think global and act local

- Increasingly used as a strategy - Toyota

Choosing an International Strategy

- Choice is dictated by the firms internal and external environments

- Influenced by cross-country differences in market conditions, culture, demographics, etc.

- Greater differences make things more complicated for firms

- These differences also drive the pattern of international competition that exists in an industry

- Greater differences then multidomestic

- Fewer differences then global

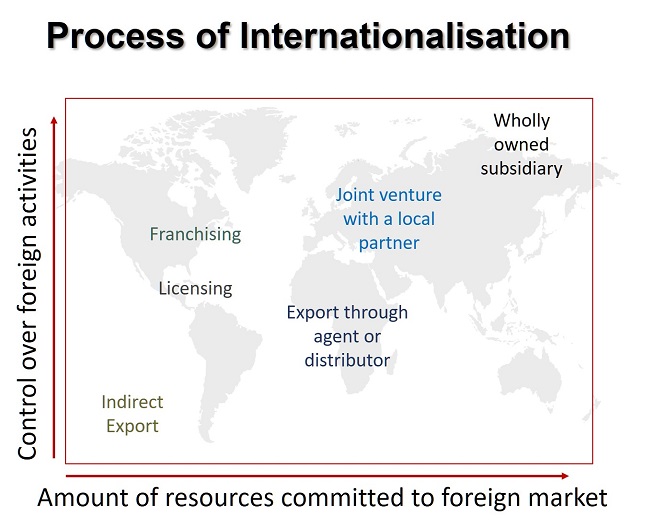

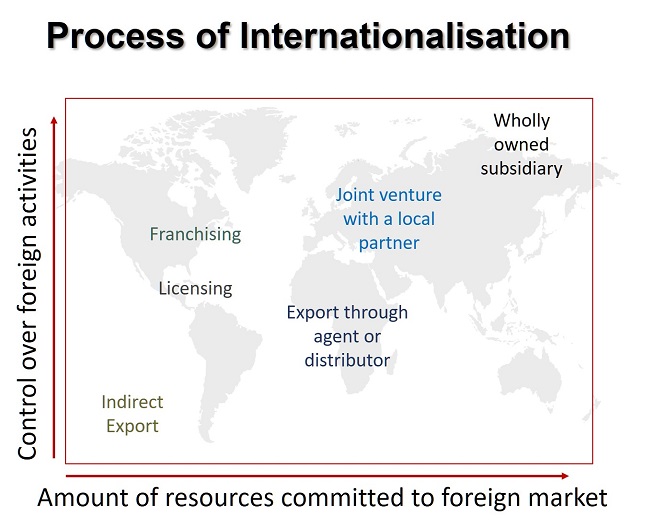

International Entry Modes

Market Entry Modes Criteria for Selection

- The company objectives and expectations relating to the size and value of anticipated business

- The size and financial resources of the company

- Existing foreign market involvement

- The skills, abilities and attitudes of the company management towards international marketing

- The nature and power of the competition within the market

- The nature of existing and anticipated tariff and non-tariff barriers

- The nature of the product itself, particularly any areas of competitive advantage, such as trademark or patent protection

- The timing of the move in relation to the market and competitive situation

Exporting

- Initial strategy used by many firms to test international markets

- Involves low expense to establish operations in host country

- Often involves contractual agreements with host country firms

- May have some tariffs imposed

- Involves high transportation costs

- Offers low control over marketing and distribution

Indirect Export

Motives & Advantages

- Low risk

- Simple

- Limited commitment & investment

- Due to concentration

- Distant but promising market demanding special knowledge

Problems & Disadvantages

- Added costs because of distribution chain

- Limited information flow

- Inactive (limited learning). Lack of market contact

- Lack of control over marketing mix

- Dependence on middleman

Direct Export

Motives & Advantages

- Shorter distribution chain

- More direct contact

- Knowledge:

- market

- distribution

- customer

Problems & Disadvantages

- More knowledge & skill demanding

- Greater financial demands

- Middlemen may present a problem (compared to Own Exporting)

- Government

Requirements

- Knowledge

- Personnel

- languages (oral & written)

- export sales, market planning & implement

- export manager (responsibility, planning)

- Commitment

- continuous activity

- top management

Own Export

Motives & Advantages

- Filterless & Rapid contact

- Long-term customer relationship development enabled

- Selling & marketing can be based on Customer Base

- Control

Problems & Disadvantages

- No permanent presence

- No buffer stock

- Large & expensive export staff when many markets/customers

Preconditions

- All that is demanded by Direct Exporting

- Ability to deal directly, with no intermediary help

- Ability to compete with local competitors (efficiency, skills, knowledge about customer)

- Advantage over local distributors (middlemen)

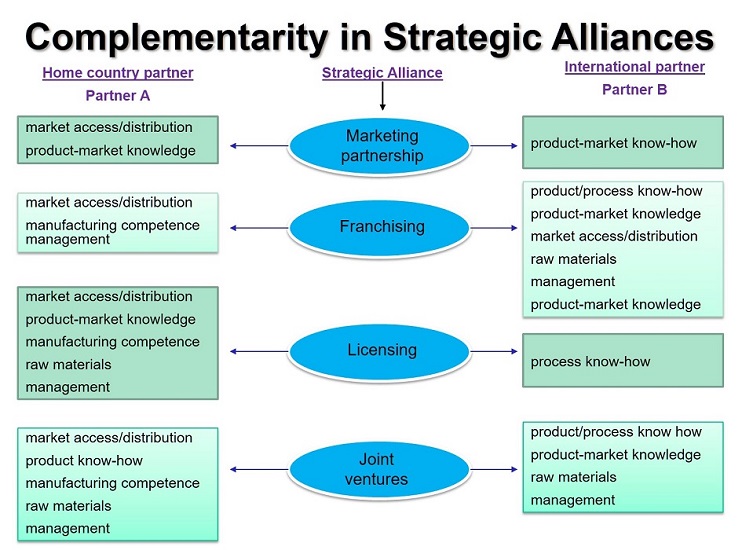

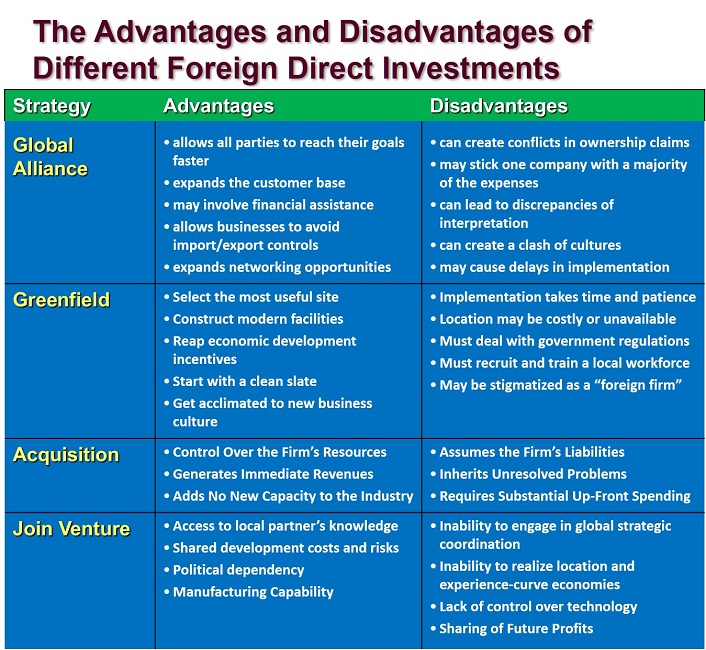

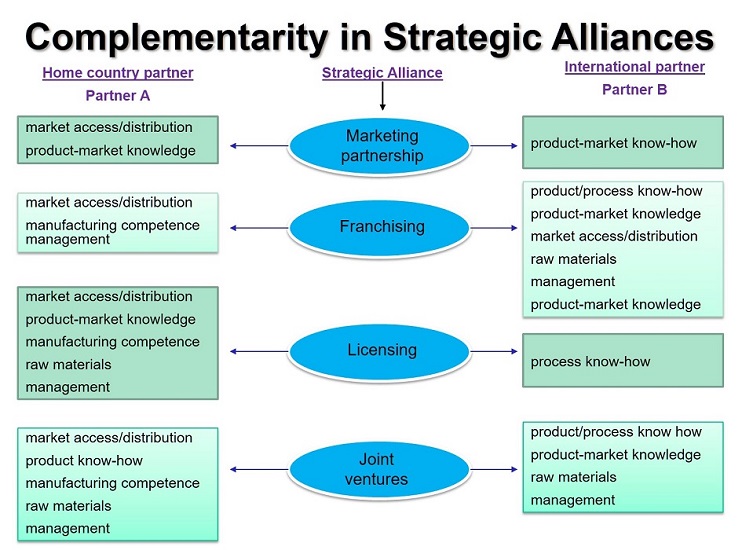

Strategic Alliances

- Strategic alliances refer to cooperative agreements between potential or actual competitors. Range from formal joint ventures to short-term contractual agreements

- Strategic alliances are attractive because they

- facilitate entry into a foreign market

- allow firms to share the fixed costs and risks of developing new products or processes

- bring together complementary skills and assets that neither partner could easily develop on its own

- help a firm establish technological standards for the industry that will benefit the firm

- But, the firm needs to be careful not to give away more than it receives

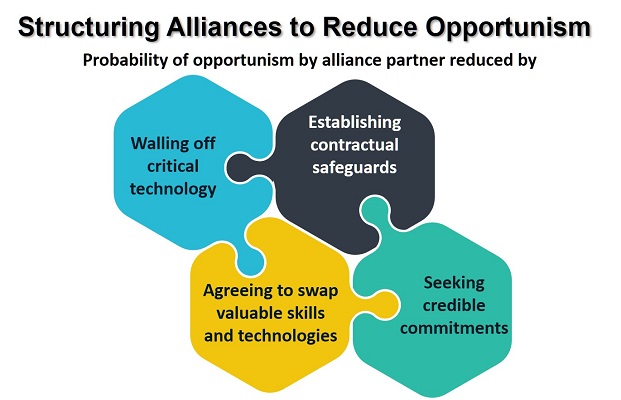

The success of an alliance is a function of

- A good partner

- helps the firm achieve its strategic goals and has the capabilities the firm lacks and that it values

- shares the firm's vision for the purpose of the alliance

- will not exploit the alliance for its own ends

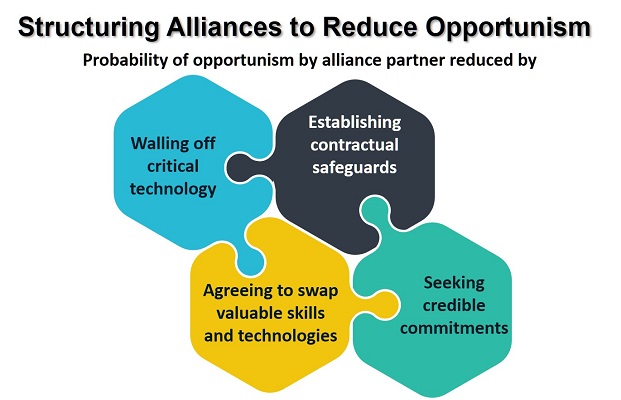

- Alliance structure. The alliance should

- make it difficult to transfer technology not meant to be transferred

- have contractual safeguards to guard against the risk of opportunism by a partner

- allow for skills and technology swaps with equitable gains

- minimize the risk of opportunism by an alliance partner

- The manner in which the alliance is managed Requires:

- interpersonal relationships between managers

- cultural sensitivity is important

- learning from alliance partners

- knowledge must then be diffused through the organization

Strategic Alliances

Advantages:

- Facilitate entry into market.

- Share fixed costs.

- Bring together skills and assets that neither company has or can develop.

- Establish industry technology standards.

Disadvantage:

- Competitors get low cost route to technology and markets.

- Alliances Are Popular

- High cost of technology development

- Company may not have skill, money or people to go it alone

- Good way to learn

- Good way to secure access to foreign markets

- Host country may require some local ownership

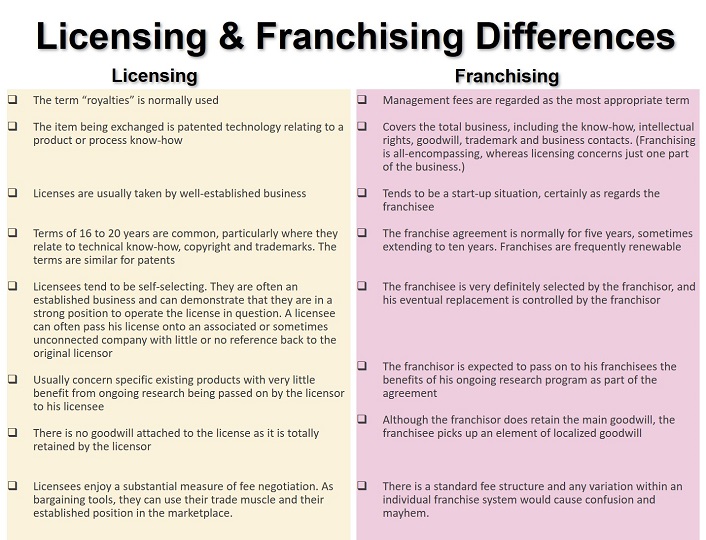

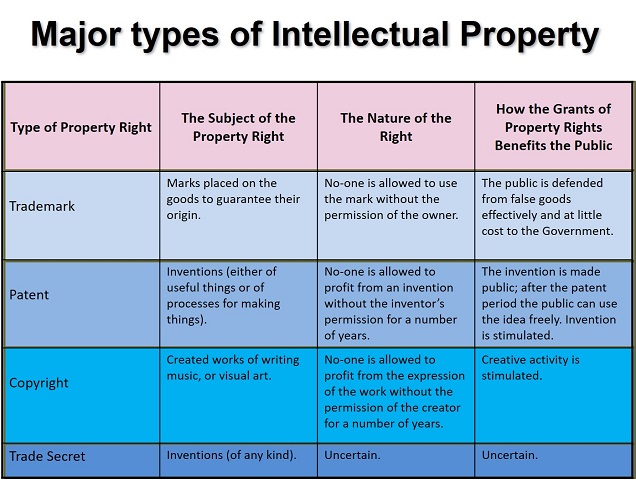

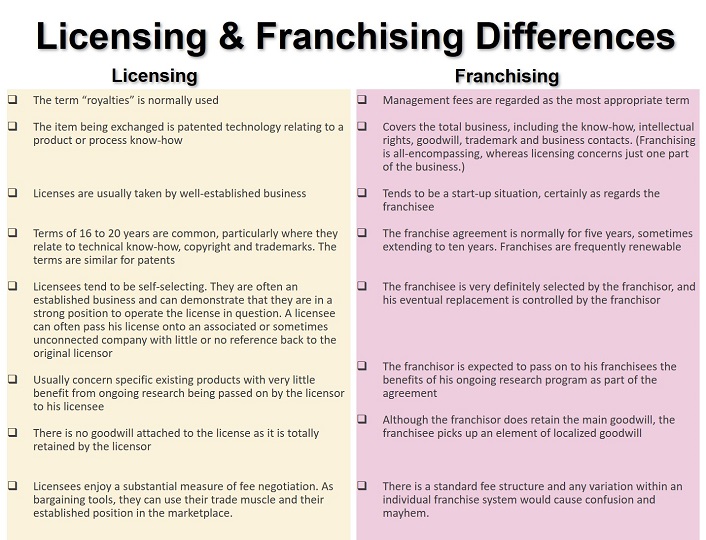

Licensing

- Allows a foreign company to purchase the right to manufacture and sell the firm's products within a host country or set of countries

- Licensor paid royalty on units sold

- Involves low cost to expand internationally

- Allows licensee to absorb risks

- Has low control over manufacturing and marketing

- Offers lower potential returns (shared with licensee)

- Involves risk of licensee imitating technology and product for own use

- May have inflexible ownership arrangement

- Works well for manufacturers (while franchising works well for services and retailing)

Advantages

- Leverage local knowledge of licensee

- Commercial and political risks absorbed by licensee

- Allows resources to be concentrated in more lucrative markets

- Adds to firm's manufacturing capacity

- Enables firms to enter several markets quickly

Disadvantages

- Licensee may become competitor

- Lack of control over licensee operations

- Uncertainty of licensee's marketing capabilities and product quality

- Licensee may exploit company resources

- Returns may be lost

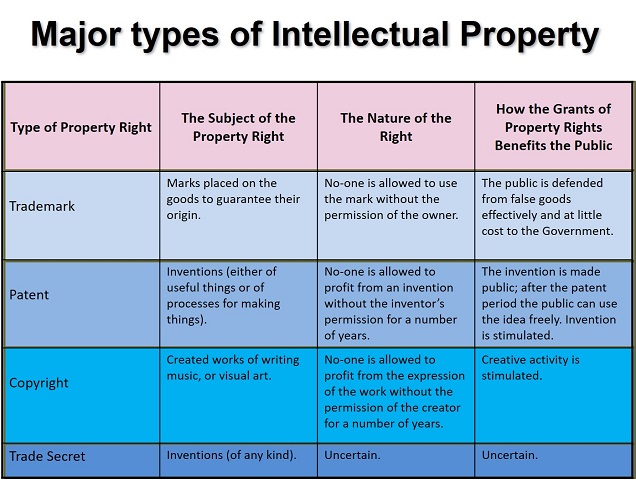

The Licensing Package

- The Licensing Package determines the combination of the various elements: both tangible and intangible.

- The intangibles usually influence how the licensing is classified.

- Many classifications have been used:

- Product patent licensing

- Process patent licensing

- Design patent licensing

- Trademark licensing

- Copyright licensing

- Know-how licensing

- Software licensing

Examples of combinations:

- The Know-how necessary to use the patent

- All necessary know-how and patents

- Patents and trademarks to increase protection

- Trade secrets to increase dependence

Reasons given for failure, in order of frequency :

- Inadequate market analysis by licensor.

- Product defects not known or understood by licensing executives.

- Higher start-up costs than licensee anticipated.

- Insufficient attention, interest and support from licensee's top management, marketing, engineering and production executives.

- Poor timing.

- Competition (not just local or other American competition, but from third country competitors).

- Insufficient marketing effort on the local scene (by licensor and/or licensee).

- Inadequate licensee "after sales" effort.

- Weakness in licensee market research and competitive intelligence.

Three out of every 10 foreign licensing arrangements in the last six years failed in some important way to come up to expectations.

"If we have any one cause for failure which stands out above all others it is an unwillingness to commit to new product introduction ventures the 'marketing resource' that is required to compete in the foreign market."

The major remedies involve:

- Providing better screening and research for foreign ventures.

- Revamping the organization that handles licensing responsibilities.

- Improving procedures and communications between product divisions, the international division and the licensee or joint venture partners.

- Ensuring better control of product quality and engineering support on part of licensor.

Most of the companies who failed in their offshore ventures have now taken positive steps to strengthen their licensing or joint programs and increase the likelihood of overseas market success.

Almost all companies realize and admit that these failures could have been avoided if they had retained expert advisers to counsel and guide them prior to their "do-it-yourself" approach.

FRANCHISING

What is Franchising?

- A form of business in which the creator (franchisor) of a business idea, method, product or service obtains distribution through affiliated dealers in foreign markets (the franchisees)

- Granting the franchisees the right to do business in a prescribed and standardized manner over a certain period of time, in a specified place

- Giving the franchisees exclusive access to certain know-how

- The method, product or service being marketed is identified (tm, brand), protected and promoted by franchisor

- Control is maintained over quality, standard and marketing methods used by the franchisor

- Although some business people think that it is a specialized form of licensing in which the franchisee is allowed to use intangible property (trademark, brand name), the fact that the franchisee is required to agree on abiding by strict rules as to how it does business makes a lot of difference.

- International franchising refers to entering foreign markets by the above method

Characteristics of Franchising

- A contractual relationship in which the franchisee carries out a business under a name owned by or associated with the international franchisor according to a certain business format established and protected by the franchisor

- The market offering is standardized, quality standards maintained and business format is controlled by the international franchisor

- Franchisor provides assistance to the franchisee in running the business both prior to commencement and throughout the period of the contract

- The franchisee owns his/her business, which is a separate entity from that of the franchisor. The franchisee provides and risks his own capital

- The franchisor manages the business

The Most Important Impediments to International Franchising

- Locating good and reliable franchisees overseas

- Knowing how to franchise overseas

- Protection of industrial property and trademarks in foreign countries

- Obtaining information on market prospects overseas

- Familiarity with business practices overseas

- Foreign government regulations on business operations

- Foreign regulations or limitations on royalty fees

- Negotiation with foreign franchisees

- Foreign regulations or limitations on entry of franchise business

- Collection and transfer of franchisee fee

- Quality or quantity of product or service

- Providing technical support overseas

- Pricing franchise for a foreign market

- Advertising franchise overseas

- Sourcing and availability of raw materials, equipment, and other products

- Shipping and distribution of raw materials required to operate a foreign franchise

- Financing franchise operations overseas

- Shipping and handling of equipment needed to operate a foreign franchise

Advantages

- Greater degree of control

- Franchisor do not bear the costs and risks of investment

- Avoid political/economic problems and restrictions in a country

- Quicker international expansion possible

- Precursor to FDI

Disadvantages

- Limited in coordinating international strategy against competitors

- Loss of control over quality and service

- Free riding

- Costs of protecting brand name

- Problems with local legislation

- Underperforming franchisees

Turnkey Operations

- Turnkey projects involve a contractor that agrees to handle every detail of the project for a foreign client, including the training of operating personnel

- At completion of the contract, the foreign client is handed the "key" to a plant that is ready for full operation

- Turnkey projects are attractive because

- They allow firms to earn great economic returns from the know-how required to assemble and run a technologically complex process

- They are less risky in countries where the political and economic environment is such that a longer-term investment might expose the firm to unacceptable political and/or economic risk

- Turnkey projects are not attractive when

- The firm's process technology is a source of competitive advantage

- May create a competitor.

- Selling process technology may be selling competitive advantage as well.

- No long-term interest in the foreign country.

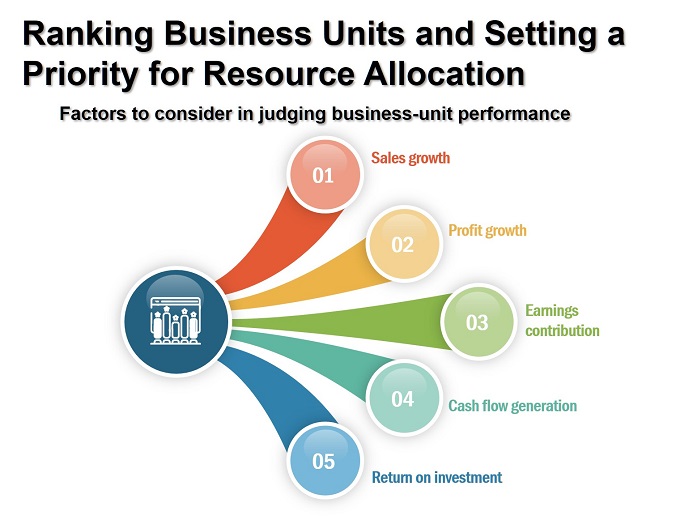

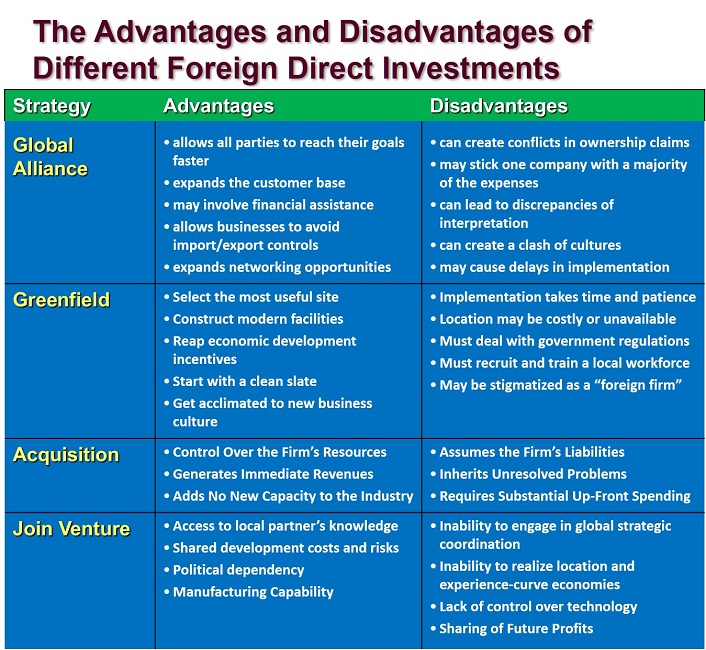

Foreign Direct Investment

Strategic Competitive Outcomes

- International diversification: A strategy through which a firm expands the sale of its goods or services across the borders of global regions and countries into different geographic locations or markets

- Strategic Competitive Outcomes

- International diversification and returns

- As international diversification increases, firms' returns initially decrease, but then increase quickly as firm learns to manage international expansion

- Firms that are broadly diversified into multiple international markets usually achieve the most positive stock returns

- International diversification and innovation

- Potential to achieve greater returns on innovations while reducing risks of R&D investments

- Exposure to new products and processes and the opportunity to integrate this new knowledge into operations

- Provides incentives to innovate

- Competitive advantage potential

- Locating activities

- Transferring competencies

- Coordinating activities

- Profit sanctuaries and cross market subsidization

- Political Risks

- The possibility of the disruption of operations by political forces or events in host countries, home country, or as a result of changes in the international environment

- Economic Risks

- Fundamental weaknesses in a country or region's economy with the potential to cause adverse effects on a firm's international strategies

- Management Problems

- Larger more complex firms are more difficult to manage

- There are limits to international expansion

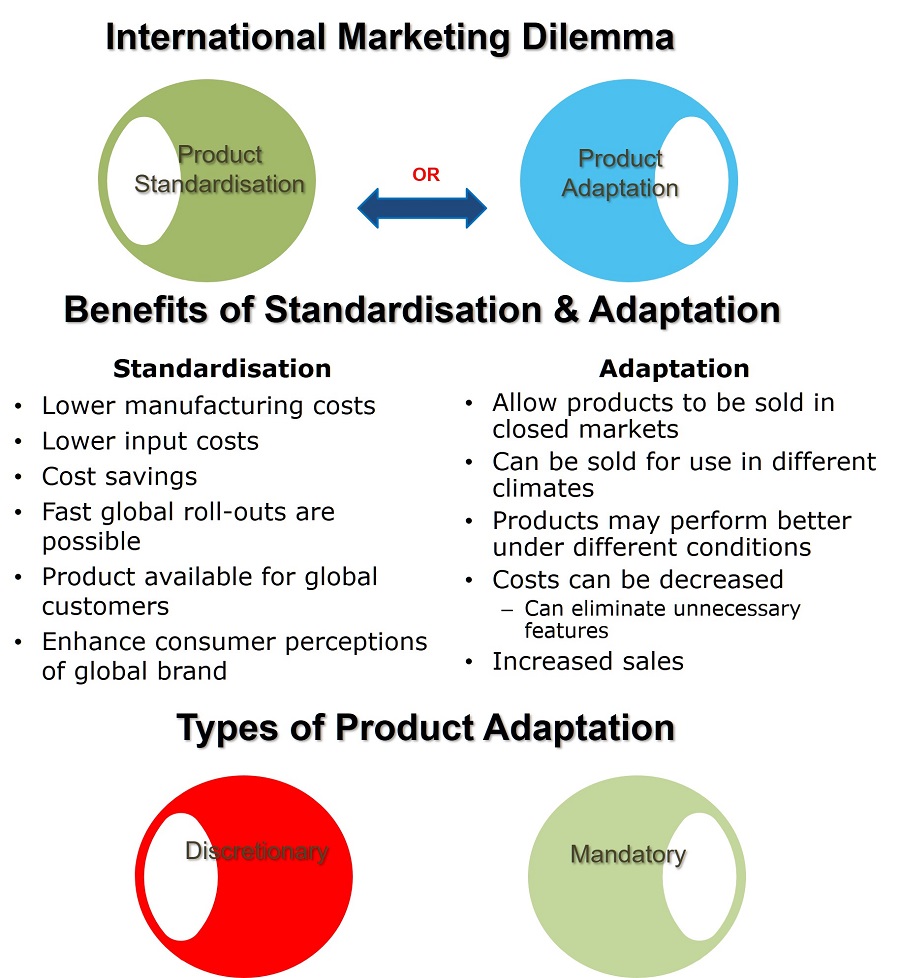

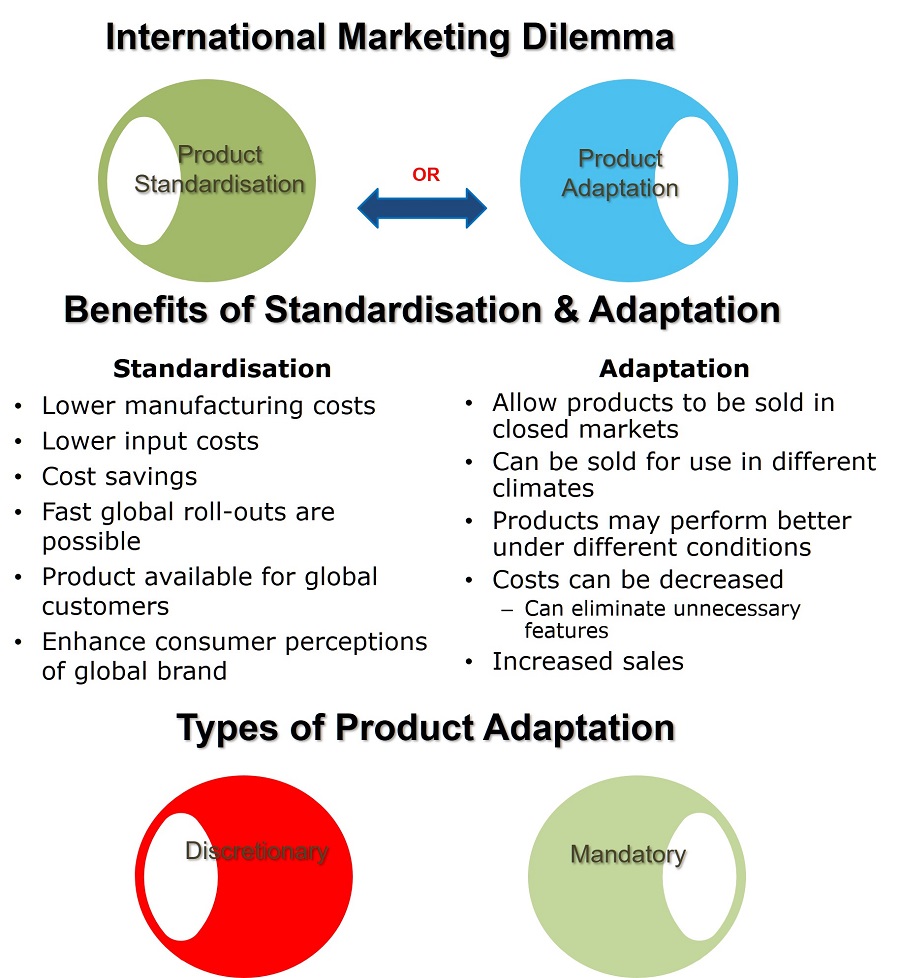

Product Strategy

Reasons to Adapt

Regional, country or local characteristics

- Government regulations; non-tariff barriers; customer characteristics, expectations & preferences; purchase patterns; economic development; climate & infrastructure

Product Characteristics

- Constituents; brand; positioning; packaging; usage; quality; performance; maintenance; CoO

Company Considerations

- Profitability; cost of adapting; product-market fit

Functions of Branding

- To distinguish a company's offering and differentiate one particular product from its competitors

- To create identification and brand awareness

- To guarantee a certain level of quality and satisfaction

- To help with promotion of the product

Local vs Global Branding

Local Brands

- Better response to local needs

- Flexible pricing

- Easier to respond to competition

- Possibility of balancing a portfolio of brands (ripple effect)

Global Brands

- Strong economies of scale

- Unique brand image

- Speed to market

- Supporting budgets for global communications

- Speed to market

- Supporting budgets for global communications